Correct Private Finance Administration

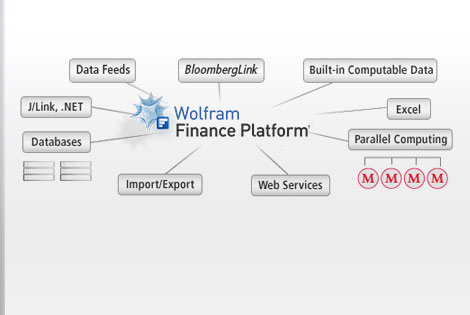

Monetary administration focuses on ratios, equities and money owed. 1. The care to be exercised by prime administration in the design of projects and programmes of the institute, significantly when such selections may lead to acquisition of, fastened assets and therefore involve capital expenditure. In the course of the renovation, the Investment Studio was created within the library to accommodate high-finish financial databases equivalent to Bloomberg and Thomson Reuters (now Refinitiv).

The game is designed to consolidate and apply strategies discovered within the Calmeadow Financial Administration Training Module I: Accounting, by taking gamers via a year in the life of a micro-mortgage fund as they move around a board containing eventualities and transactions.

A part of efficient strategic financial administration thus might contain sacrificing or readjusting quick-term objectives with a purpose to attain the corporate’s long-time period goals more efficiently. One platform from which to synchronize all accounting and invoicing, create tax provisions, prepare for fluctuating cash flow and carry out their enterprise, stress-free.

Strategic financial management encompasses all the above plus steady evaluating, planning, and adjusting to maintain the corporate targeted and on observe towards long-time period goals. The classification of cost info into variable, fixed, capital and recurring …