Design A System And Work The System

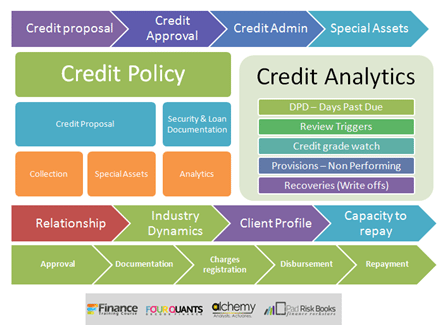

Fighting unpaid invoices? In the event you obtained a letter or call from us, it means your financial institution or creditor has made a business resolution to sell your debt. Utilizing efficiency indicators for customers, using a credit scoring system and the shortcomings of credit scoring systems.

Your company didn’t cause the present credit disaster – but it’s going to be up you to make sure your small business survives it. Generally individuals use their bank cards for therefore many budgeted payments, they cannot pay all of the bank card bills; not even the monthly minimal funds.

Full Credit score Management reporting software together with the DSO reporting, the overdue ratio reporting and the unhealthy money owed reporting. We’re at all times respectful in all our dealings with our shoppers and their prospects honouring the social contract between them.

Such a coverage has energy to breathe new life into your entire credit score-to-money course of. Furthermore, with a debt consolidation company you possibly can have your overall credit card debt lowered by several 1000’s of kilos. Our tactful incremental approach to Accounts Receivable management avoids alienating your prospects or purchasers whose accounts have turn out to be late.

With the …