Might The 1987 Inventory Market Crash Happen Again?

Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps hundreds of thousands of people attain monetary freedom by means of our web site, podcasts, books, newspaper column, radio show, and premium investing companies. Investment corporations and main bankers tried to stabilize the market by shopping for up nice blocks of inventory, producing a reasonable rally on Friday. Volatility profiles based on trailing-three-12 months calculations of the standard deviation of service funding returns as of February 28, 2017.

It is also the specialist’s job to make sure that there’s a market for their specified stocks always, which means they’ll make investments their very own firm’s capital at times to keep the market lively and keep the shares’ liquidity.

This index weighs its elements equally instead of the normal practice of weighing them by their market capitalization. These have been the first trendy joint inventory companies This allowed the businesses to demand extra for his or her shares and construct bigger fleets.

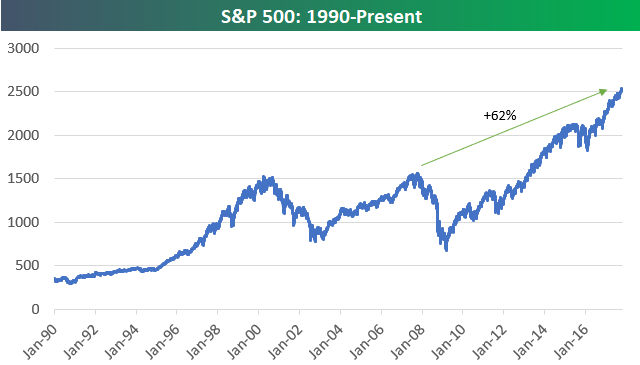

However lengthy-term rates are necessary not simply because of the alternatives available to you right this moment, but as a result of in an environment friendly market they should be an excellent forecast of what future …