Crash & News Updates

The “Stock Market” is a time period that’s usually misapplied to what are known as financial “markets” or financial “exchanges.” Although stocks represent only a fraction of the particular monetary value of all the assorted kinds of monetary instruments (akin to government and private industrial bonds, brief-time period debt agreements, and international foreign money) purchased and bought in the midst of any given day, most of the people tends to overlook these activities. This is a perfect automated stock software possibility for more informal traders or newer traders without an excessive amount of experience throughout the stock market. Inventory buying and selling is principally one thing and that is understanding provide and demand within the market.

Rupee down: The rupee surrendered all its early positive factors and closed 19 paise decrease at sixty nine.65 towards the US dollar Monday amid strengthening of the dollar towards Asian currencies and rising crude oil costs. To facilitate this process, an organization wants a marketplace the place these shares may be offered.

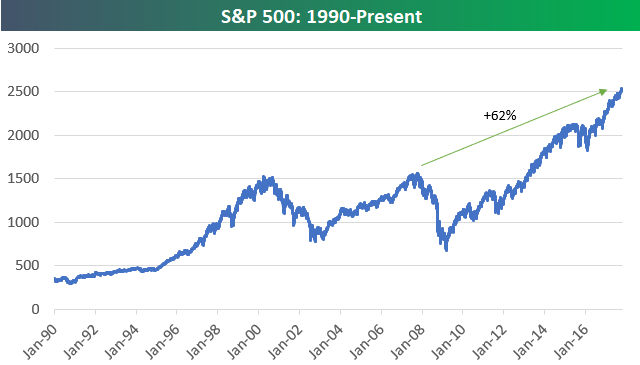

As noted equities rallied sharply over the final 4 days of the trading week, including respective good points for the Dow 30, NASDAQ, and S&P 500 Index of 263, 127, and 30 …