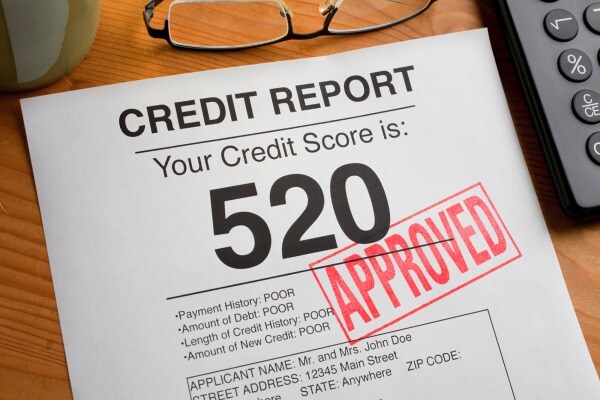

How To Buy A House With Dangerous Credit score In 6 Steps (Up to date 2017)

This web page consists of analysis of our favorite playing cards from The Easy Dollar’s advertisers and the marketplace. Nursing Scholar Loans funds lengthy-term, low-curiosity loans to needy students enrolled in full-time or half-time dentistry, optometry, pharmacy, podiatric or veterinary drugs applications. Once you have established these two objects, subsequent look for transparency in fees and loan phrases.

Most borrowers with this lender truly report quick upticks of their credit score scores. The federal loan packages out there for graduate students are Direct Unsubsidized Loans and the Direct PLUS loan. If you don’t have a credit score historical past, or have a nasty credit score historical past, you’re seen as an even bigger financial threat.

As well as, some pupil lenders do not rely solely on the FICO score to make approval, they will have a look at your entire credit historical past into consideration when evaluating a possible borrower’s loan utility. The minimal credit rating is simply 550 and typical APRs vary from 25.10{cff03c76ffe922ad7bfe3e5b75e3b928c85cb6dd1563fdeed2a3c1e92b2fcae5} and 36{cff03c76ffe922ad7bfe3e5b75e3b928c85cb6dd1563fdeed2a3c1e92b2fcae5}.

These loans are want-based mostly, so if you merely exhibit a need for monetary assistance you’ll be considered eligible. You probably have bad credit score, then you’re probably all too familiar with the …