NH Bad Credit score Auto Loans

We understand that generally folks run into monetary problem by no fault of their own. Private student loans for college students with unhealthy credit are generally difficult to find. The annual share price (or APR) is the annualized rate of interest that you are charged on a private mortgage. However, if you already have unhealthy credit score, you might find it useful to check loan provides with an expert to help decide how completely different choices can have an effect on your payments.

OneMain is a effectively-established lender particularly targeting people with bad credit score. If you have unhealthy credit and wish a graduate student loan, discovering someone with good credit score and having them conform to co-signal the mortgage with you will help your cause.

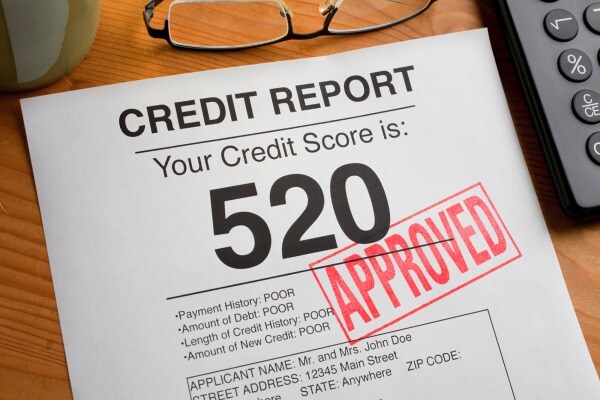

Most private lenders use your FICO credit score rating to find out should you qualify for a mortgage. So although house loans for dangerous credit score exist, it doesn’t suggest you need to go for it. As a substitute, you might be better off taking the time to improve your credit situation.

College students should apply for loans by means of their school’s or university’s scholar support workplace. In distinction, an installment loan is …