Monetary Accounting Versus Cost Accounting

Mainly Bookkeeping or Accounting is the recording of day to day enterprise monetary transactions; transactions include sales, purchases, revenue, and payments by an individual or organization. Our financial Accounting and Reporting Framework companies (FARFS) assist companies to fulfill such requirements, together with the preparation of monetary statements and regulatory filings, Monetary Reporting Requirements (IFRS) and also assist in the understanding of this modifications and requirements throughout the organization and in addition achieving the an total performance and success of the business.

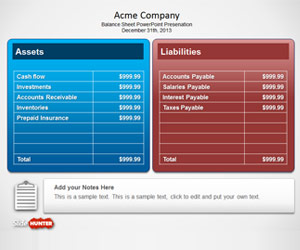

All restricted firms are required to produce a press release of assets and liabilities and maintain a system of monetary control and invariably have to undertake a system of double entry bookkeeping normally utilizing an accounting software bundle.

GAAP (Usually Accepted Accounting Principles) are different from IFRS (Worldwide Monetary Reporting Requirements) as a result of below GAAP guidelines, dividends obtained through a enterprise’s investing actions is actually reported under the operations actions instead of investing activities.

As the accounts don’t require to produce a trial stability and balance sheet then when utilizing self employed bookkeeping recording money and bank transactions will not be strictly necessary however extremely recommended to supply additional financial management.

For example, from the identical basic data trial steadiness is prepared; trading and revenue and loss account may be prepared; listing of debtors and creditors could also be prepared; purchases and sales forecast could also be made and so on. So, an efficient knowledge-base administration is needed to provide flexibility in uses of information.