Profession Path & Skills

Monetary analysts are fortune tellers, if you consider it. Financial analysts information people and businesses in making investments. An advanced financial analyst place usually requires an MBA diploma with an appropriate subject focus or a grasp’s diploma in finance. The work of a financial analyst includes providing guidance to both companies and people when they’re marking investment selections.

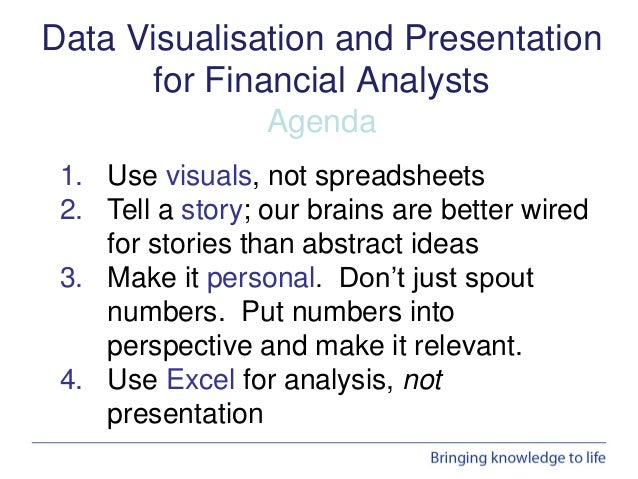

Financial analysts must additionally examine business trends and financial developments, and put together written reports on these developments and forecasts for their clients. Analysts which are promoted additionally learn to develop communication and folks skills by crafting written and oral displays that impress senior management.

The U.S. Bureau of Labor Statistics (BLS) estimated that roughly 268,360 folks labored as monetary analysts in 2015 (). Employment of economic analysts was expected to grow by 12{cff03c76ffe922ad7bfe3e5b75e3b928c85cb6dd1563fdeed2a3c1e92b2fcae5} between 2014-2024, which is quicker than average progress. Spreadsheets and statistical software program packages are used by monetary analysts to investigate financial data and tendencies in addition to create portfolios and develop forecasts.

Studying how to become a monetary analyst is step one toward constructing that future. Many financial analyst jobs require licensure from the Monetary Trade Regulatory Authority (FINRA). This increase will require corporations to hire monetary analysts to advocate in addition to analysis investments.

Many analysts also specialize even further inside a specific sector or business. Kinds of financial analysts include portfolio managers, fund managers, ratings analysts and risk analysts. Ten {cff03c76ffe922ad7bfe3e5b75e3b928c85cb6dd1563fdeed2a3c1e92b2fcae5} of analysts obtained a base pay of $44,490 or less, and ten percent earned $141,seven hundred or extra.